ACA Compliance: It’s Time for Your Annual ACA Physical

The following article has been contributed by BenefitPitch Solution Partner, Michael Weiskirch. Michael is the Principal and Founder of EmployeeTech, a stand-alone full-service ACA filing provider supporting thousands of employers nationwide.

It was an ordinary Monday morning until their finance department received a letter from the IRS. The letter, filled with pages of regulations, was requesting a penalty of $280,000 for failure to file and furnish their 2021 1094 and 1095 ACA reporting. It required a response date within 30 days. Finance immediately reached out to HR for answers. Sadly, the HR department turned over two years ago and specific knowledge concerning 2021 was difficult to track down. Several questions persisted. Did they manage it through their payroll system? What about covered dependents? Did their broker provide this service? There were no clear answers.

This story is common in a space where HR staff, benefits recordkeeping and support have been in flux for some time. While ACA requirements have been well understood for over a decade and nothing new or earth shattering has happened in the last few years, employers have changed. And just like your own personal health, there is a risk that any employer could fall out of compliance. Below are some basic concepts that should be reviewed annually to ensure you are meeting the compliance needs of the employer.

Note: While we do discuss 1095 B requirements, this article is mostly focused on the C filing.

Make Sure You Are Counting Correctly

If an employer is an Applicable Large Employer (ALE) by averaging over 50 full time employees in the prior year, they need to file the 1094/5 C with the IRS. For most employers, the ALE calculation is a simple one; are they over or under fifty in the prior tax year? If they do not have many part-time employees and are clearly over or under the number then it is usually a “back of the envelope calculation”. It only gets tricky when they are close to an average of 50 full-time equivalent employees or have a lot of employees who might vary their hours.

How to Calculate ALE Status

When calculating ALE status, employers need to count average part time employees along with full time employees. Here’s a simple example below:

40 Full-Time Employees + 20 Half-Time Equivalent Employees = 50 FTEs.

Yes, this is an ALE!

The other component to this calculation is how you look at ownership. In basic terms, if the same organization owns 80% or more of another company, you need to aggregate the total. Again, here’s a simple example:

Company A with 30 Employees Owns Company B with 15 Employees and Company C with 5 Employees = 50 FTEs.

Yes, this is an ALE!

Under 50? You May Still Have a Filing Obligation

If an employer is below 50 FTEs and self-funded for any period during the year, they will need to file a 1095 B with the IRS. B filings have increased due to the growth of leveling funding in the small employer market. Some carriers of these self-funded plans file on behalf of the employer, but other payors simply provide the data, putting the filing responsibility back on the client. EmployeeTech also saw a significant increase in B clients during 2023 due to the transition from paper to electronic filing for most sized employers (the IRS reduced the paper filing limit from 250 to 10 forms in 2023).

Watch Affordability Like You Watch Interest Rates

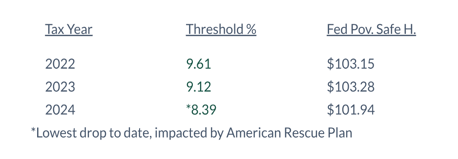

The measurement of an affordable health plan is fundamental to maintaining compliance for any ALE. First the lowest cost single monthly contribution employers offered to employees needs to be below the affordability threshold percentage of the lowest monthly salary. So, for example, if the lowest salary is $25,000, the plan contribution should be below $174.79 ($2083/mo x 8.39%). If you want to make things easy, target this plan contribution below the Federal Poverty Safe Harbor and simplify reporting methods — no need to disclose an amount. At the same time, some employers are more closely tied to affordability. In the table below, the affordability percentage dropped significantly for 2024, which could shift the employer out of compliance from previous years.

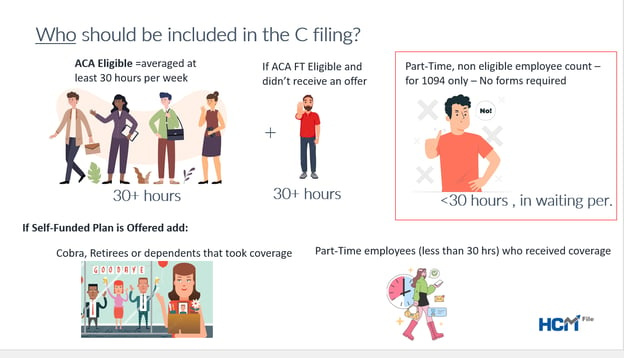

Double Check Who Should be included in the Filing

All full-time (30+hour) employees that reached eligibility (met their waiting period) should receive a 1095 C form. This includes terminated employees, however it does not include employees who failed to satisfy their waiting period. In addition, if an employer is self-funded, they need to include non-employees such as retirees, COBRA, and any covered dependents. We often find that HR and payroll solutions struggle to include non-employees in the filing because these individuals do not reside in the system. It is advisable to check the HR/payroll or benefits system to make sure it supports these compliance needs.

2024 Deadlines (To be Filed in 2025) – No Surprises Here

With the elimination of the paper filing for most employers and the permanent forms deadline in place, there are only two dates you need to be focused on for ACA filing compliance:

- Deadline forms should be mailed to employees – Monday March 3, 2025

- Deadline for IRS electronic filing – Monday March 31, 2005

The State Where You Live Matters

When it comes to The ACA, if an organization has employees that reside in the states of California, New Jersey, Rhode Island as well as the District of Columbia, you will need to file an additional annual filing. It is important to ask the ACA filing provider if they cover this group of employees in their filing. If not, they need to be filed separately.

Be sure to also keep in mind that California has an earlier deadline for 1095 C forms, requiring distribution by January 31st for self-funded plans.

Finally, it is also worth noting that the state of Massachusetts has its own separate employer level filing with the state. This filing began prior to the ACA and is usually completed by the carriers.

After You File With the IRS, the Work is Not Done in Most Cases

Unfortunately, most ACA filings will require some clean up after being submitted. There are three statuses employers can receive from the IRS, with possible follow up required. It is important that an employer’s ACA filing solution can help resolve these post-filing issues if they arise:

- Rejected: If there are errors in the filing such as the wrong tax ID, or notable errors in the data being submitted, the IRS will reject the filing. Employers who receive the rejection status are required to correct it within 60 days of the error.

- Accepted with Revisions: This is the most common status employers receive. It often means that some of the employee’s social security numbers and names do not match with the IRS database. Sometimes the IRS has it wrong and needs to update things on their end. In this case, you “do nothing”. But if the name that was filed is incorrect or the SSN is off, it is recommended that you try to correct it. Note the deadline for these is not firm. IRS language states “as soon as possible” .

- Accepted: In the rare case, some employers have their filing fully accepted by the IRS. If this happens, the work is done!

What to Do If You Received an IRS Penalty Letter

It is common for an employer especially with larger and diverse populations to receive an IRS penalty letter. In general, the remedy to an IRS penalty notice is to resolve the issue and respond back within the 30-day window from the date of the letter or the “last date to respond”. If you receive a 226-J letter you can revise the coding for each employee requesting PTC credits and return it within the time window. If you receive a notice that you have not filed, seek a solution to resolve all filing needs and respond back alerting the IRS of the remedy. All other issues may require support from legal or outside counsel.

Final Note

ACA filing has been around for ten years and is familiar to most Applicable Large Employers. At the same time, several variables shift year to year, so an annual check-up is generally a good idea. It is also important for employers to allow enough time to complete their annual ACA filing as deadlines can creep up. As a matter of practice, check with the solutions provider, payroll company or benefits administration system in advance of the filing year to make sure they are set to support the annual compliance needs.

Michael Weiskirch is Principal and Founder of EmployeeTech, a stand-alone full-service ACA filing provider supporting thousands of employers nationwide. For more information regarding EmployeeTech and their HCM File solution feel free to connect with Michael at mweiskirch@employeetech.com